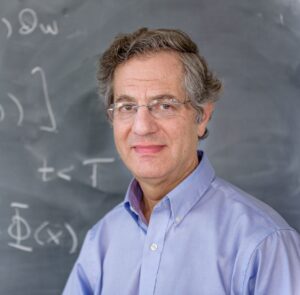

BRUNO DUPIRE

Instructor since 2005

After having headed derivatives research teams at Societe Generale, Paribas and Nikko FP, Bruno joined Bloomberg in New York in 2004 to develop advanced analytics. He is best known for his work on volatility modelling, including the Local Volatility Model (1993), simplest extension of the Black-Scholes-Merton model to fit all option prices, and subsequent results on stochastic volatility and volatility derivatives. He was included in December 2002 in the Risk magazine “Hall of Fame” of the 50 most influential people in the history of derivatives. He is the recipient of the 2006 “Cutting edge research” Wilmott award and was voted in 2006 the most important derivatives practitioner of the past 5 years in the ICBI Global Derivatives industry survey.