The Present of Futures: Valuing Eurodollar-Futures Convexity Adjustments in a Multi-Curve World (June 19, 2017)

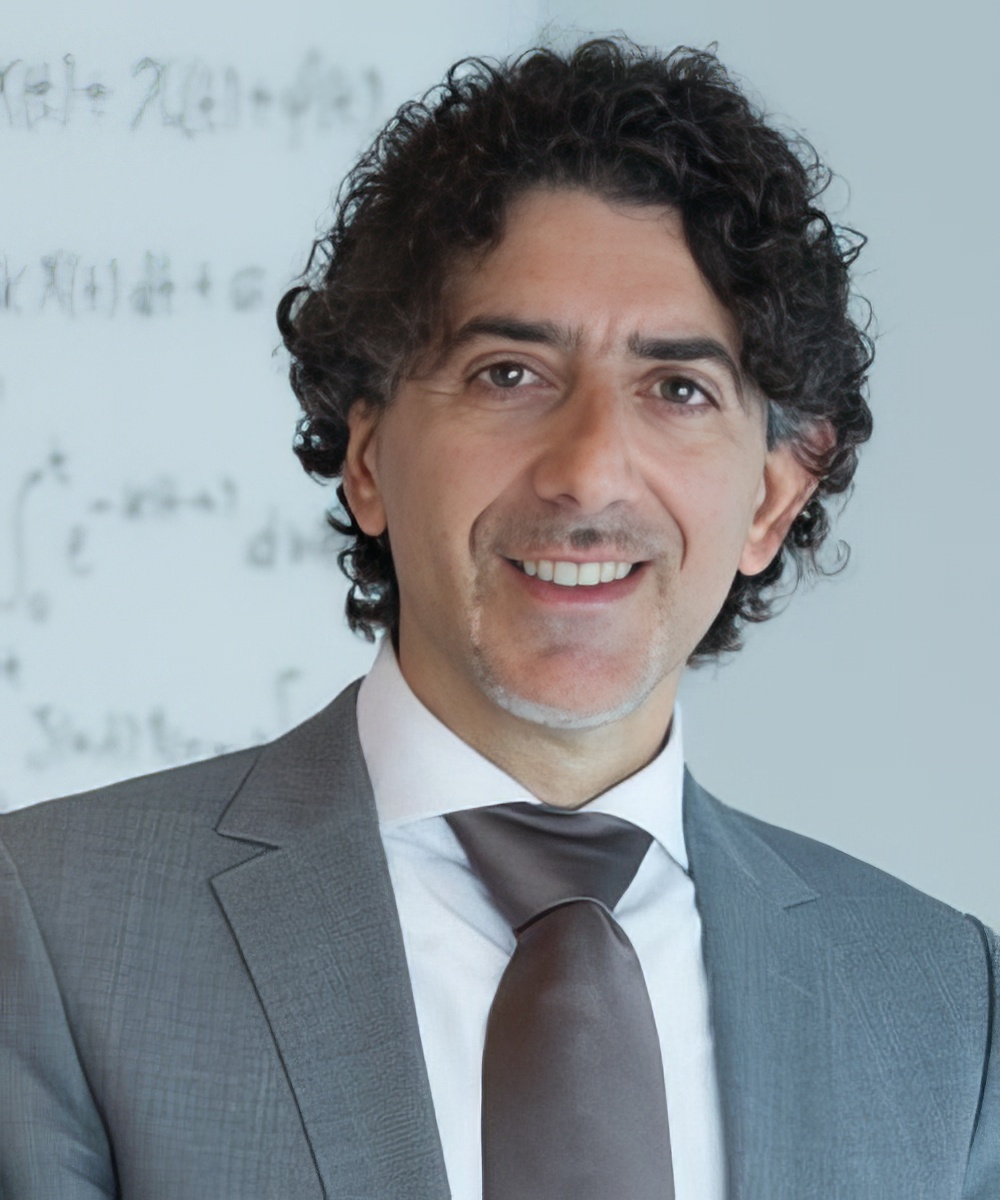

Fabio Mercurio

VIEW PUBLICATION

The Basis Goes Stochastic: A Jump-Diffusion Model for Financial Risk Application (August 26, 2016)

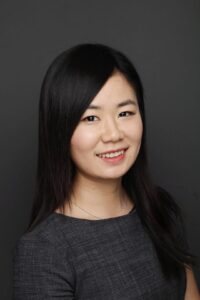

Fabio Mercurio and Minquang Li

VIEW PUBLICATION

umping with Default: wrong-Way-Risk Modeling for Credit Valuation Adjustment (August 23, 2016)

Fabio Mercurio and Minqiang Li

VIEW PUBLICATION

Analytic Approximation of Finite-Maturity Timer Option Prices (March 2015)

Fabio Mercurio and Minqiang Li

Closed-Form Approximation of Perpetual Timer Option Prices (June 2014)

Fabio Mercurio and Minqiang Li

VIEW PUBLICATION

Bergman, Piterbarg and beyond: Pricing Derivatives under Collateralization and Differential Rates (December 18, 2013)

Fabio Mercurio

VIEW PUBLICATION

The Basis Goes Stochastic (December 2012)

Fabio Mercurio and Zhenqiu Xie

Interest Rates and the Credit Crunch: New Formulas and market Models (May 2010)

Fabio Mercurio

VIEW PUBLICATION

Modern LIBOR Market Models: Using Different Curves for Projecting Rates and for Discounting (2010)

Fabio Mercurio

VIEW PUBLICATION

Analytical Pricing of the Smile in a Forward LIBOR Market Model (2010)

Fabio Mercurio and D. Brigo

VIEW PUBLICATION

LIBOR Market Models with Stochastic Basis. (June 2010)

Fabio Mercurio

VIEW PUBLICATION

Inflation modelling with SABR dynamics (June 2009)

Fabio Mercurio and N. Moreni

Joining the SABR and Libor models together (March 2009)

Fabio Mercurio and N. Moreni

Cash-settled swaptions and no-arbitrage (February 2008)

Fabio Mercurio

Parameterizing correlations: a geometric interpretation (2006)

Fabio Mercurio and A. Castagna

The Vanna-Volga Method for Implied Volatilities (January 2007)

Fabio Mercurio , F. Rapisarda, and D. Brigo

Smiling at convexity: bridging swaption skews and CMS adjustments (August 2006)

Fabio Mercurio and A. Pallavicini

Inflation with a smile (March 2006)

Fabio Mercurio and N. Moreni

Consistent Pricing and Hedging of an FX Options Book (2005)

Fabio Mercurio L. Bisesti, and A. Castagna

Pricing Inflation-Indexed Derivatives (2005)

Fabio Mercurio

he LIBOR Model Dynamics: Approximations, Calibration and Diagnostics (2005)

Fabio Mercurio, D. Brigo, and M. Morini

Smile at the Uncertainty (May 2004)

Fabio Mercurio, D. Brigo, and F. Rapisarda

Approximated Moment-Matching Dynamics for Basket-Options Pricing (2004)

Fabio Mercurio, D. Brigo, F. Rapisarda and R. Scotti

Alternative asset-price dynamics and volatility smile (2003)

Fabio Mercurio, D. Brigo, and G. Sartorelli,

Analytical Pricing of the Smile in a Forward LIBOR Market Model (2003)

Fabio Mercurio and D. Brigo

Lognormal-Mixture Dynamics and Calibration to Market Volatility Smiles (2002)

Fabio Mercurio and D. Brigo

Joint Calibration of the LIBOR Market Model to Caps and Swaptions Volatilities (2002)

Fabio Mercurio and D. Brigo

A Deterministic-Shift Extension of Analytically-Tractable and Time-Homogeneous Short-Rate Models (2001)

Fabio Mercurio and D. Brigo

A Family of Humped Volatility Models (2001)

Fabio Mercurio and J. Moraleda

Claim Pricing and Hedging under Market Incompleteness and Mean-Variance Preferences (2001)

Fabio Mercurio

A Mixed-up Smile (September 2001)

Fabio Mercurio and D. Brigo

Lognormal-Mixture Dynamics and Calibration to Volatility Smiles and Skews (July 2001)

Fabio Mercurio, D. Brigo and G. Mauri

Option Pricing Impact of Alternative Continuous Time Dynamics for Discretely Observed Stock Prices (2000)

Fabio Mercurio and D. Brigo

An Analytically Tractable Interest Rate Model with Humped Volatility (2000)

Fabio Mercurio and J. Moraleda

Correction: Is Ito calculus oversold? (April 1999)

Fabio Mercurio and D. Brigo

Option Pricing with Hedging at Fixed Trading Dates (1996)

Fabio Mercurio and A.C.F. Vorst

Option Pricing for Jump-Diffusion: Approximations and Their Interpretation (1993)

Fabio Mercurio and W.J. Runggaldier

Modelling Interest Rates (May 31, 2009)

Fabio Mercurio

Interest Rate Models - Theorgy and Practice: With Smile, Inflation and Credit (August 2, 2006) Show less

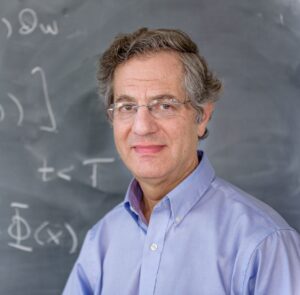

Damiano Brigo & Fabio Mercurio